Freight in Flux: Tariffs, Recovery, and Amazon’s LTL Disruption

Like most of the business world, the freight and transportation markets spent much of the first quarter trying to predict and adapt to the new administration’s tariff and trade policies. Some of the changes were put into action while others were proposed but never fully mobilized—a reality that led to some “tariff whiplash” as organizations sorted through the changes, assessed the potential impacts and took action to mitigate any negative consequences.

For most of the quarter, these and other events kept the freight markets on their toes but didn’t really create any major shifts, rate increases, or capacity issues. While each mode of transportation experienced its own set of circumstances, for the most part the broader market chugged along at the pace that it came into 2025 with.

On a positive note, the trucking market is showing signs of recovery after a protracted downturn. According to Transport Topics, some trucking executives are talking openly about how freight growth and efficiency gains are positively impacting their operations.

On a positive note, the trucking market is showing signs of recovery after a protracted downturn. According to Transport Topics, some trucking executives are talking openly about how freight growth and efficiency gains are positively impacting their operations.

“I think we are going to get back to normal, and things are going to get better,” Bob Costello, Chief Economist of American Trucking Associations (ATA), announced at a recent industry conference. “It’s not going to be the pandemic boom, but we are absolutely moving in the right direction.”

The lengthy downturn has taken a toll on carriers. “I think we’re all flabbergasted with how long this has lasted,” one trucking executive said. “From a trucking standpoint, I think you just need to be prepared for a potential recovery but also some prolonged pain here.” Another executive summed up the situation with: “Frustrated. Fatigued. There are a lot of different ways to describe how we feel.”

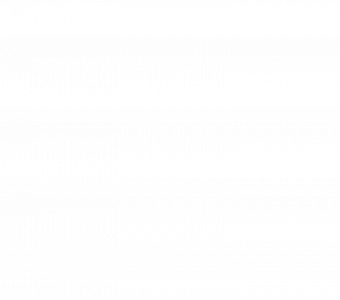

Tariffs Took Center Stage

Proposed tariffs and retaliatory actions were obviously a moving target throughout much of the first quarter of 2025. Economists and analysts kept busy predicting the impacts of tariffs as they were announced, only to have those new levies backburnered in lieu of other ones.

In the runup to Q1, the transportation industry was “flatlining to slightly negative,” says Charles Craigmile, President and CEO at Revenova. This trend was evident in the earnings reports for large, public carriers and brokerages. “If you look at their truckload and LTL groups, it was sideways growth to sometimes negative,” says Craigmile. The November presidential election brought hope of more “free market dynamics” and potential market recovery, which subsequently emerged in January and February.

The tariffs have tempered some of the positive momentum. “With the tariffs being rolled out in a clunky manner, it created some uncertainty,” Craigmile says. For example, there was a multi-day period in March when containers stopped moving at certain ports because no one knew the right tariff rate to levy. “To clear boxes across borders, all of the paperwork has to be in order and that wasn’t happening.”

The proposed automotive tariffs were of particular concern to the transportation sector, which came into the second quarter braced for double-digit tariffs on automotive imports originating in numerous different countries. These duties follow tariff increases on imported goods from mainland China as well as increased tariffs on imports of steel and aluminum from global sources, S&P Global reports.

“With almost half of US Class 8 heavy truck sales produced in Mexico, all else being equal, the proposed 25% tariffs on Mexico would influence truck imports and exports as well as manufacturing, pricing, profitability and volume,” the publication adds.

“Commercial vehicle forecast impacts are, as yet, unclear, owing to questions on the tariffs’ duration and timing,” it continues, “but we no longer believe that a quick resolution of the trade disputes, in under two months, is likely.”

Amazon is Taking LTL In-House

In other Q1 news, it looks like e-tailing giant Amazon may take its less-than-truckload (LTL) business in-house in a move that aligns with many of the company’s other vertical integration strategies. “If Amazon pursues an acquisition to handle LTL shipping in house, it would provide a windfall for the acquired carrier while removing a sizeable chunk of retail demand from the rest of the market,” Cubiscan’s Scooter Sayers told Trucking Dive.

Amazon is currently developing a Dispatch & Disruption team for Amazon Freight Less-Than-Truckload and is on a mission to create a “disruptive transportation product,” the publication adds, noting that the e-tailer moves a “staggering number of shipments” through carriers’ LTL networks.

“Even if they never open up their LTL capacity to the open market,” Sayers points out, “they are a threat to the LTL carriers as they can pull business away from them over time.” On the other hand, Amazon’s jump into the LTL sector could have a positive impact on an industry “in which incumbent carriers generate great profits and strong pricing power.”

To learn more about Revenova TMS, Request a Demo. Follow Revenova on LinkedIn, YouTube, and X for the latest updates and news about Revenova TMS, the original CRM-powered Transportation Management System.